By Grace Thornton

The Alabama Baptist

Jim Swedenburg can’t remember the last time a month went by that he didn’t hear at least one report of an Alabama Baptist church dealing with a significant misappropriation of money.

“And if we’re hearing about one, there’s probably nine others we aren’t hearing about because they are handled locally,” said Swedenburg, director of the office of Cooperative Program and stewardship development for the Alabama Baptist State Board of Missions.

Recent survey

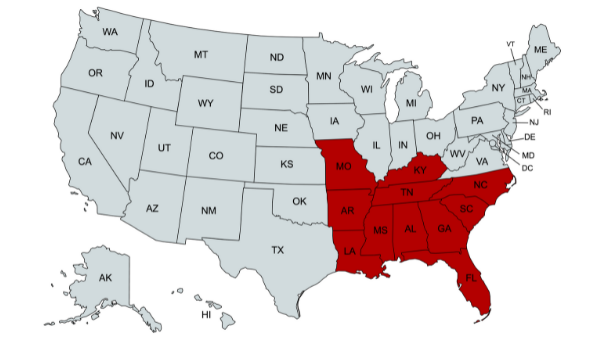

LifeWay Research backs up his sentiment — according to a new survey, about 1 in 10 Protestant churches nationally has had someone embezzle funds. A smaller study done in Kansas and Missouri five years ago found similar data — 13.4 percent of churches had seen embezzlement or another type of fraud happen.

“It absolutely is more common than churches think,” Swedenburg said.

Mishandling of money can range from major embezzlement to a clerical error that sends money to the wrong place, he said.

“I doubt that there’s any churches in our state that haven’t had some money mishandled, they just don’t know about it,” Swedenburg said. “It could be individuals taking up money for events, or money used in youth activities — there are so many different things that can happen.”

Churches want to assume that they can trust, and it’s important to find people they trust, he said. “But we also hold people accountable. I use a quote from Ronald Reagan often — he used to say ‘trust and verify.’”

The best practice to verify that money is being held correctly is to separate duties, Swedenburg said — don’t have the same person doing all of the steps.

The same person who writes the check shouldn’t be the one who signs it, and the person who signs it shouldn’t be the one who sends it, he said.

At the same time, “always have two people looking at each step in the process,” he said. “The main thing is you never want to have money be handled by one single person. There should always be two people in the loop with each step.”

Churches also should have an audit done each year, Swedenburg said, though he noted that it can be expensive to have an external audit.

“It’s pretty expensive, so many try to alternate and have an internal audit for two years and an external one every third year,” he said. “The most important thing is to do it — there is a very high percentage of our churches who have never had an audit.”

According to the LifeWay study, 34 percent of pastors say their church’s most recent audit was more than five years ago, that their church has never had an audit or that they don’t know when their last church audit was.

At the very least, churches should do an audit of their controls to see how their money is being handled, Swedenburg said. “If you do that, you can pick up on some of the danger signs that leave you vulnerable to something bad happening.”

One key step churches can take in this audit is to run credit checks on anyone who handles money, he said. “If they’ve got a low credit score, they aren’t handling money well in their personal life. It also lets you know that they need money.”

Keep a paper trail

Other steps? Always keep a paper trail of where money goes and train your financial secretary and your treasurer, he said. Record all gifts and send quarterly contribution statements. Handle accounts and receipts with care.

Swedenburg’s office offers at least two workshops per year for this type of training.

Share with others: