By Grace Thornton

The Alabama Baptist

As Mike Jackson travels around the state meeting with churches in transition, he says one question comes up more and more frequently than any others.

“What I’m seeing is a lot of churches who are wrestling with should we move from full-time ministry to bivocational when it comes to hiring a pastor,” said Jackson, director of the office of LeaderCare and church health for the Alabama Baptist State Board of Missions (SBOM).

“Most realize they’ve got to be able to help a pastor make a living one way or another, and they’re asking themselves if they can afford to continue to hire one full time.”

Lee Wright, coordinator of church compensation services for the SBOM, said a number of factors contribute to that.

Economic factors

Some are economic — giving to churches took a hit with the Great Recession and, though the economy has largely recovered, churches are still recovering financially.

At the same time the costs of employing a full-time pastor are ever rising, Wright said. One of those costs is health care.

“I read back in the ’90s that around 90 percent of churches provided health insurance,” he said. “Today it’s a lot fewer. It’s just so expensive.”

The cost of health insurance has stabilized recently — a moderate 6 percent raise in costs in 2019 — but it’s still high, he said. It sometimes can be hard for a church to afford it for full-time or part-time pastors and that often puts the burden on the pastor and his family.

Some have opted for medical-sharing ministries or the health care marketplace. Others have found other ways of getting insurance that require more commitment from the pastor’s family.

“We see the pastor’s wife working largely for the health insurance, or a pastor driving a school bus on the side to get insurance,” Wright said.

He said he remembers the advice young men who were interested in ministry were given years ago — to avoid considering any other kind of job.

“They would say, ‘If you’re going to be a professional at ministry, don’t have an alternative career because you’ll take that as an out,’” he said.

It’s the total opposite of that today, Wright said. “I think every minister who is preparing for ministry should be able to serve bivocationally.”

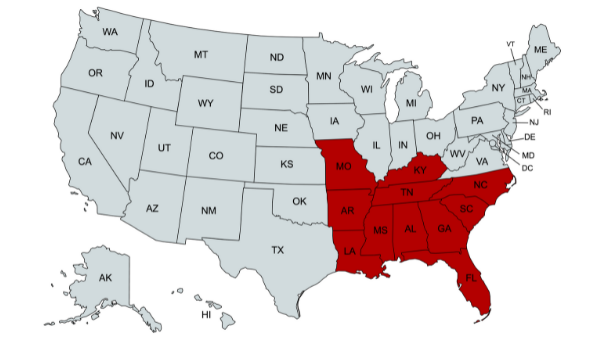

More than 50 percent of Alabama’s pastors are bivocational — a way churches and pastors can meet in the middle when finances are a struggle.

But whether a church hires a full-time pastor or a bivocational one, there are a few things churches should keep in mind, Wright said.

- Remember that better compensation means a better functioning pastor.

It’s not that compensation is everything to a minister but providing for him adequately can free him up to do ministry more effectively and with less stress. Younger pastors have a big hill to climb in ministry these days to find financial stability, according to a Christianity Today article called “The Pastor’s Pay in 2019 and Beyond.”

In fact the article cites a 2018 ChurchSalary poll that found 3 in 10 church leaders personally knew someone who had left the ministry because of inadequate pay. Pay is a little better for full-time pastors in Alabama than the nationwide average, Wright said.

But even so the 2018–2019 Layman’s Salary Study states there’s still room for improvement. In Alabama full-time pastor compensation rose but didn’t keep up with inflation the past two years. The state’s full-time pastors are 9 percent behind in benefits and bivocational pastors are 10 percent behind the national average in compensation. There’s an even greater deficit for them in benefits.

- Avoid the package approach.

Some churches will give a pastor a lump sum of money and let him decide how he wants to spend it — whether as salary, health insurance or other types of benefits.

“When they talk about salary with a pastor they will say, ‘Here’s X number. Divide it up how you want to,’” Wright said. “What typically happens is he’ll designate a certain amount as car allowance and that does him no good if he doesn’t have an accountable reimbursement plan.”

- Be aware that pastors can’t write off expenses as they could in the past.

Gone are the days when pastors could write off business expenses like cars on their taxes, Wright said.

Helping pastors

“A lot of ministers would tell me in the past that they didn’t want an accountable reimbursement plan because it was a hassle,” he said. “But they are an employee for federal purposes and this would be under Schedule A itemized deductions. Before they would itemize it as unreimbursed business expense and that’s totally gone. Lots and lots of pastors don’t know that yet.”

Churches can help their pastors by providing them with a dedicated housing allowance.

“It doesn’t cost the church anything to do it that way,” Wright said. “Many churches want to help their minister and help avoid paying any unnecessary taxes, they just don’t do it the way it needs to be done to make that happen.”

To access the 2018–2019 Layman’s Salary Study, visit alsbom.org/ccs. The study includes worksheets that your church can use to take a look at its compensation structure.

Share with others: