EDITOR’S NOTE (March 20, 2020): This article from 2017 highlights several aspects of online giving, including some services. In light of the coronavirus pandemic and changes in church meeting, we are sharing this link again, though some of the information may be out of date.

Digital giving options ‘essential’ for churches as Americans write fewer and fewer checks

By Carrie Brown McWhorter

The Alabama Baptist

Today’s givers vary widely in their giving preferences and interest in electronic giving is rising. But does e-giving make sense for your church? The answer is worth considering.

Americans are writing fewer paper checks and roughly eight in 10 people carry less than $50 cash in their wallets on a regular basis, according to a 2014 report from Bankrate.com. That probably means many people in the pews are passing on the offering plate because they simply don’t have anything to put in it.

“Current information about checking accounts and actual paper checks tells us that the average family in the United States now writes less than one check a month on average,” said Jim Swedenburg, director of the office of Cooperative Program and stewardship development for the Alabama Baptist State Board of Missions. “It is essential for churches to provide digital giving options if they want to be successful at collecting offerings from the generation that is dependent on the cell phone for almost everything.”

And consider this: the typical church takes up an offering only on Sunday, usually during Sunday morning worship and sometimes on Sunday nights. The downside? Givers who miss a service may not follow through with the offering they intended to give.

The upside? There are approximately 166 hours in the week outside of Sunday church services when an individual might be inclined to give.

Whether that’s a memorial donation after someone’s death, a gift spurred by a Facebook post about a missions trip or simply a missed weekly offering, those moments when individuals are inspired to give may be lost if the person doesn’t have an easy way to follow through with a financial gift.

Potential increase

“Different giving studies show that the potential for most churches is around a 17 percent increase in giving simply by adding an option that allows them to give electronically,” Swedenburg said.

Churches today have many options for accepting gifts, including:

• Traditional giving. Checks and currency are placed directly into the offering plate. Occasionally a check may be mailed to the church but most of the time givers in attendance make their offering when they are present.

Pros: Procedures are generally in place for accepting and recording the offering.

Cons: Sundays missed for vacation or illness may result in unpredictable offerings, including decreased giving during summer months and holidays. Administrative costs generally include banking fees and/or salaries for accounting staff.

• Electronic checks or e-checks. These are online payments, similar to bill pay, initiated through the giver’s bank. E-checks are paper checks sent from the bank through the mail so in order to receive them, the church should provide a specific recipient who will record the check and add the amount to the church’s account of total offerings.

Pros: Givers can set up regular offerings and avoid delayed or missed giving opportunities.

Cons: A system of accounting for offerings received outside of traditional giving opportunities must be in place and the church must provide specific instructions to givers.

• ACH transfers. Similar to e-checks, Automatic Clearing House (ACH) payments are initiated from the giver’s personal bank account but instead of a check, the money goes directly into the church’s account. ACH payments are direct transfers from one account to another. The church generally will need to provide an Authorization Agreement for Automatic Withdrawals (ACH Debits) Form to a giver to start this process.

Pros: Like e-checks, ACH gifts happen on schedule. Also, ACH donations tend to have no fee attached but the ones that do are inexpensive.

Cons: A system must be in place to acknowledge and report gifts.

• Credit and debit card payments. These two forms of payment work essentially the same. However, a credit card is a promise to pay later whereas a debit card draws from the user’s bank account. That difference is significant to many churches who teach against credit card use as an issue of stewardship, and for good reason. A 2016 study by NerdWallet.com found that the average U.S. household with credit card debt carries balances totaling $16,748. Many churches choose only to accept debit card payments if they take plastic.

Pros: Ease of use and preferred over cash and checks by many. Apps and/or software make gifts possible 24/7 through the church’s website.

Cons: Fees are generally higher for card transactions than for checks or ACH transfers. Church may want to set up a giving kiosk or swipe station, which will incur additional costs and/or fees.

• Text-to-give and mobile giving. These options also rely on electronic transactions utilizing ACH transfers, credit cards or debit cards and are generally completed using a smartphone or other device.

Pros: Americans are increasingly spending money using their smartphones so texting and mobile giving fit their lifestyle.

Cons: Additional costs or fees may be incurred to set up or use these options.

Swedenburg said a church finance committee should carefully consider the options for online and mobile giving before entering into an agreement. And just as with traditional giving, a plan should be in place that protects confidential account information and provides digital security to all givers.

Sound accounting procedures should be in place to account for all donations, regardless of whether they are given in a traditional way or electronically, he said.

___________________________

Evaluate fees, flexibility, services provided with electronic giving options

By Carrie Brown McWhorter

The Alabama Baptist

E-giving technology is a rapidly developing field with changes and innovations being introduced every day, said Jim Swedenburg, director of the office of Cooperative Program and stewardship development for the Alabama Baptist State Board of Missions (SBOM).

Online giving also poses some interesting questions about empty offering plates and giving as an act of worship. What does it say to others, especially children, about giving if one never puts anything into the offering plate?

Dan Wunderlich, a blogger at DefiningGrace.com, writes that “when we invite worshippers to place their tithes and offerings in the plate, basket, bag, joy box, etc., they (online givers) are left out.”

He recommends providing an “I Gave Online” card, which allows online givers to participate in giving as an act of worship and serves as a tangible reminder to the giver and those around them that an offering has been given.

Possible increase

Research suggests church offerings will increase when givers have the option to give online.

But online giving does come with associated costs so churches must choose an e-giving service that works best for them. Here are some basics to consider:

E-giving services generally are free to givers. The church will pay a credit card transaction fee (an average of $.30 per transaction) plus a percent of the charged amount (an average of 3 percent of total transaction).

Using these averages, a church would receive $484.70 for a gift of $500 completed in a single transaction. Though transaction processing fees are relatively similar across these services, monthly fees and equipment costs for kiosks, card readers or other hardware differ widely among e-giving providers.

Some services charge a fee to process ACH transfers. Churches usually will save money if donors who want to give this way set up a giving plan through their bank instead of through the e-giving service provider.

Other questions to ask before choosing an e-giving service provider are:

• What monthly fees are associated with this service?

• How much are transaction fees and charges?

• Can I personalize my giving page or app to look like the rest of my website?

• Are there monthly minimum requirements for transactions?

• Does the service support one-time gifts and regular giving?

• Will the user/giver be directed to a page outside the church website in order to give?

• Is text giving an option and if so, what is the fee for this service?

• Are kiosks available?

• How much does each kiosk cost and is there a monthly maintenance fee?

• Will this app or software integrate with other software used in church accounting or website development?

• What steps are required to set up the church account?

• How quickly will payments post to the church account?

________________________

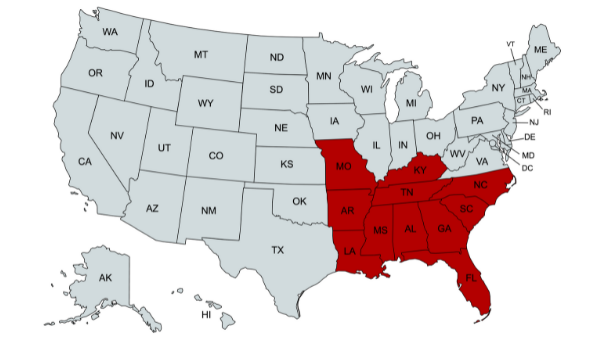

The services listed below are used by Alabama Baptist churches (listed in no particular order). Each service offers e-giving through credit, debit and ACH (eCheck).

Most offer kiosk, text-to-give and card reader options for giving as well as website integration for online giving. Most offer customizable interfaces and integrate with popular church management software packages.

Users can set up accounts with these services but there is also the option to give a one-time donation without setting up an account. Most allow churches to record cash and check donations given outside the app, create annual giving statements and be listed as the payee for completed transactions.

Each service offers a variety of pricing packages depending on a church’s needs.

• Echurch (powered by Pushpay)

• Vanco Payment Solutions

• ShelbyNext Giving

• LifeWay eGiving

• Tithe.ly

• Egiving

• EasyTithe

• SecureGive

• Square (does not support ACH transfers)

_____________________________

Read more about “Generosity and giving for believers.”

Share with others: